Real estate investment provides value to real estate investors over time because of future cash flow, asset appreciation, and tax advantages when owning rental properties. There are four characteristics of real estate that differentiate it from other investments.

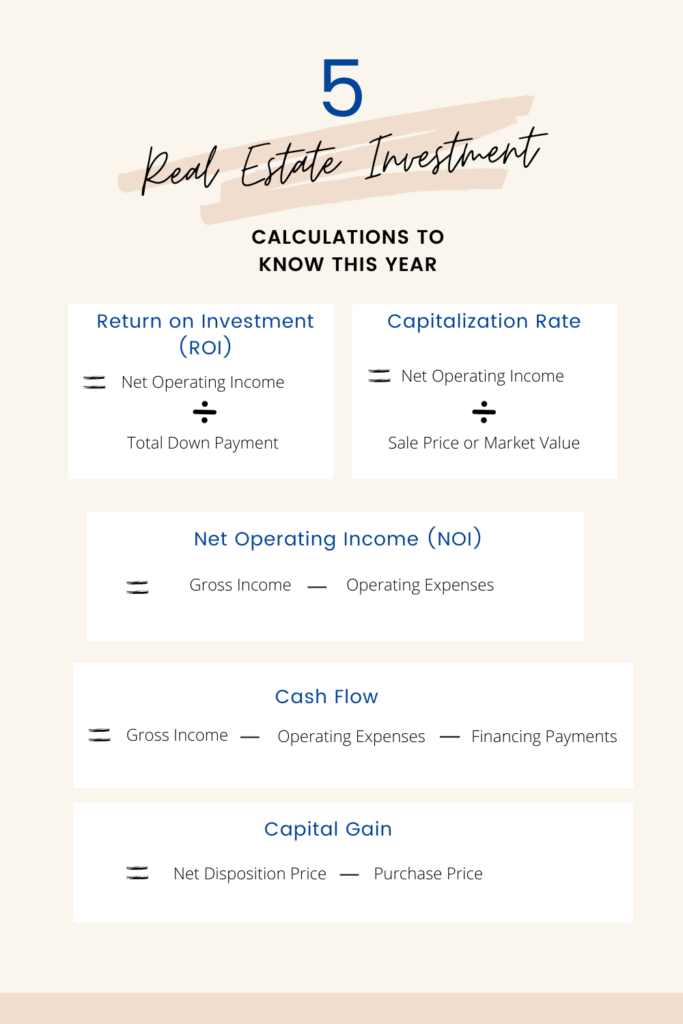

Those four characteristics that define real estate are immobility, longevity, indivisibility, and tax benefits. Below are five real estate investment calculations that are easy to use when looking for an investment property!

All real estate markets are different, and every investor’s financial goals and strategies are different. Some investors might be looking for an active real estate investment and others may be looking for more passive real estate investments.

The more involved and the riskier a potential investment is, the higher the financial upside. Whereas the more passive and less risky, the lower the potential returns. The below calculations can guide you as you look for rental property investment opportunities!

Monthly Cash Flow

Monthly Cash Flow = Gross Income – Operating Expenses – Financing Payments

Annual Cash Flow = Monthly Cash Flow x 12

For an investment to be attractive to you as an investor, the cash flow each month should be positive. The amount of cash flow a property needs to generate will differ for every investor.

If you’re new to real estate investing and want to eventually leave your day job to become a real estate investor full time, then you will likely be looking for properties with a high net cash flow.

On the other hand, if you have a good amount of savings, immediate cash flow may not be necessary. Therefore, you may be ok with purchasing a property with higher appreciation potential instead and a lower monthly cash flow.

To determine cash flow, you will look at the property’s gross income and subtract the operating expenses it costs to maintain the property. Operating expenses can include property insurance, property taxes, repair & maintenance, management, utilities, and vacancy and bad debt allowance.

Then, you will deduct any financing costs such as the mortgage principal and interest to get your monthly cash flow. Of course, your cash flow will differ based on interest rates and your downpayment amount or if you are paying for the property with cash.

Net Operating Income

Total Gross Potential Income – Vacancy and Bad Debt Allowance

= Effective Gross Income

– Operating Expenses

= Net Operating Income

To calculate the net operating income, you will use the gross potential rental income from the rental property and subtract an amount for vacancy and bad debts allowance. For multi-unit investment properties, income can also come from parking, additional tenant services, or coin-operated laundry.

The vacancy and bad debts allowance is expressed as a dollar or percentage amount. It forecasts any missed payments or months where there may be no rental income. The property’s gross potential income minus vacancy and bad debt allowance will give you an effective gross income.

Finally, the effective gross income minus any operating expenses will equal your net operating income for that property. Similarly to cash flow, the desired net operating income should be positive.

Capitalization Rate (cap rate)

Capitalization Rate = Annual Net Operating Income / Purchase Price or Market Value

The capitalization rate for a property is another important metric that is relatively straightforward. To find the capitalization rate, you will need to determine the property’s net operating income and divide that amount by the property’s sale price or market value.

The capitalization rate is expressed as a percentage and it represents the return an investor would receive on an all-cash purchase. As a result, the capitalization rate calculates the rate of return before factoring in financing and taxes, which makes it easier to compare cap rates across similar properties.

As a result, the capitalization rate is often used when quickly analyzing commercial real estate before diving deeper into other financial metrics.

Return on Investment (ROI)

ROI = Annual Net Operating Income / Down Payment or Cost

The return on investment is a profitability ratio that determines a property’s profitability based on its net operating income in a given year to the cost to acquire that asset. Unlike the capitalization rate, a property’s ROI will change depending on the investor’s financing.

ROI is a simple formula that measures the profit of an investment as a percentage of the total investment cost. A positive ROI indicates an attractive investment, while a negative ROI suggests looking for more profitable opportunities.

You should compare the subject property’s ROI with other properties you’re interested in before making your investment decision to better understand the comparables within the market.

Capital Gain

A capital gain is realized when you sell your property for a higher price than you purchased it. The capital gain is recorded at the time of the sale. When determining the amount of your capital gain, it’s essential to account for the costs and expenses to buy and sell your property.

For instance, if, after fees and expenses, you purchased a condo for $350,000 and then sold it five years later for $550,000, you would have a capital gain of $200,000. Of course, there are tax implications with capital gains, so it’s best to speak to an accountant.

Cash on cash return (coc return)

Cash on Cash Return = Annual Pre-Tax Cash Flow / Total Cash Invested

Real estate investors use cash-on-cash returns to measure the potential profitability of an investment based on the down payment amount or cash purchase price. Real estate investors should also factor in the cost of any required improvements or upgrades when calculating cash on cash return.

Cash on cash return focuses on the total amount of cash invested and is also known as a property’s cash yield.

The cash on cash return is lower when a property is purchased using all cash because there’s no risk of the investor defaulting on a mortgage. However, when a property is financed, the cash on cash return is higher, but there’s also the risk that the borrower may not make their monthly mortgage payments.

Cash on cash return is a metric used to measure the income earned on a cash investment. For example. A property purchased for $250,000 with all cash and generating $25,000 annual cash flow would be a 10% cash on cash return. $25,000 / $250,000 = 10% cash-on-cash return.

The above real estate investment formulas can be helpful for the beginning stages of your investment analysis. However, it’s also essential for investors to be familiar with the demand and supply factors influencing the specific real estate market where you are looking to invest.

Are you interested in real estate investing? These articles may be for you!

Seller's Checklist

Buyer's Checklist

Property Comparison

Instantly Get all 3 Free templates when you sign up!

*Disclaimer: The topics of discussion, content and resources on this website are general information that may not be the right solution or advice for you specifically. Not intended to solicit buyers or sellers currently under contract with a brokerage.

Privacy Policy

*Stock images from Social Squares

General Disclaimer

THIS WEBSITE IS A PARTICIPANT IN THE AMAZON SERVICES LLC ASSOCIATES PROGRAM, AN AFFILIATE ADVERTISING PROGRAM DESIGNED TO PROVIDE A MEANS FOR SITES TO EARN ADVERTISING FEES BY ADVERTISING AND LINKING TO AMAZON.CA.

Google Web Stories

(250) 589-8129

ria@mavrikoscollective.com

ADD A COMMENT

March 3, 2022